capital gains tax changes canada

Thus the current capital gains tax is 6 for both individuals. Capital losses can be used to reduce capital gains made in the same financial year or a future year including investments outside of cryptocurrency.

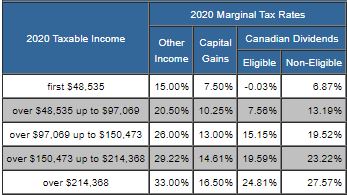

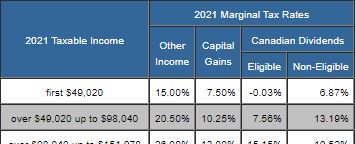

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

Some exceptions apply such as selling ones primary residence which may be exempt from taxation.

. Capital Gains and Dividends Taxes. LEXIS 204 May 16 2022 the Supreme Judicial Court of Massachusetts SJC reversed the Appellate Tax Boards holding that a nondomiciliary corporation could be taxed for its capital gains from the sale of the corporations membership interest in an in-state entity. As described by the Government of Canada adjusted cost base ACB is the cost of a property or other investment.

Report all donations of these properties on Form T1170 Capital Gains on Gifts of Certain Capital Property whether the inclusion rate is 50 or zero. Tax Foundation is Americas leading independent tax policy resource providing trusted nonpartisan tax data research and analysis since 1937. 38 - SUBDIVISION C - Taxable Capital Gains and Allowable Capital Losses.

A Capital gains tax was first introduced in Canada by Pierre Trudeau and his finance minister Edgar Benson in the 1971 Canadian federal budget. In the recent case of VAS Holdings Investments LLC vCommr of Revenue No. Congress hasnt made changes to rates on long-term capital gains and dividends for 2021 and 2022.

Estate and Gift Taxes. 1901 - Calculation of Capital Tax. That means your investments can grow and you dont have to worry about changes in value until you.

In addition to federal taxes on capital gains most states levy income taxes that apply to capital gains. This means long-term capital gains in the United States can face up to a top marginal rate of 371 percent. Which changes the way that capital gains are treated but doesnt guarantee that the individual will save any money.

50000 - 20000 30000 long-term capital gains. If capital losses exceed capital gains you may be able to use the loss to offset up to 3000 of other income. At the state level income taxes on capital gains vary from 0 percent to 133 percent.

However the portion of the capital gain that applies to the period before. The same rules apply in the case of a change of use ie. The way capital gains tax is treated varies from province to province including British Columbia.

Capital Gains Tax Rate. Expenditures Credits and Deductions. Capital gains on the sale of these properties do not qualify for the 100000 exemption.

132 The capital gains and capital losses referred to in 127 do not include certain capital gains and capital losses that pursuant to paragraph 4031a and subsection 40312 arise from the deemed disposition of a members interest as. Report the applicable amounts calculated on this form on line 13200 or line 15300 of Schedule 3 Capital Gains or Losses. However the CRA recognizes that property owners may face difficulty paying capital gains tax when a sale has not occurred.

Capital gains made by investments in a Tax-Free Savings Account TFSA are not taxed. The applicable rate is half 12 of the income tax rate which is 12 for individuals and companies after the changes to the tax code from 1 October 2018. In the case of a true sale of an investment property capital gains tax must be paid when you file your tax return for the year the sale occurred.

The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the 22 to 35 bracket levels. Individual Income Tax Rates and. If you have more than 3000 in excess capital losses the amount over 3000 can be carried forward to future years to offset capital gains or income in those years.

Recent State Tax Changes. The February 1992 federal budget eliminated the capital gains exemption for capital gains on the sale of non-qualifying real property such as cottages and rental properties. A Capital Gains tax was first introduced in Canada by Pierre Trudeau and his finance minister Edgar Benson in the.

DIVISION J - Appeals to the Tax Court of Canada and the Federal Court of Appeal. Should you sell the investments at a higher price than you paid realized capital gain youll need to add 50 of the capital gain to your income. In Canada 50 of the value of any capital gains are taxable.

190 - PART VI - Tax on Capital of Financial Institutions. Johns crypto tax obligations.

More Jobs In August In Canada Hot Dang Part Time Jobs Job Part Time

Taxtips Ca Federal 2019 2020 Income Tax Rates

The Cra Just Redesigned The T1 Personal Income Tax Return Form And There Are Some Major Changes Income Tax Tax Deadline Income Tax Return

Taxtips Ca Canada S Federal 2020 2021 Personal Income Tax Rates

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

The Cra Just Redesigned The T1 Personal Income Tax Return Form And There Are Some Major Changes Income Tax Tax Deadline Income Tax Return

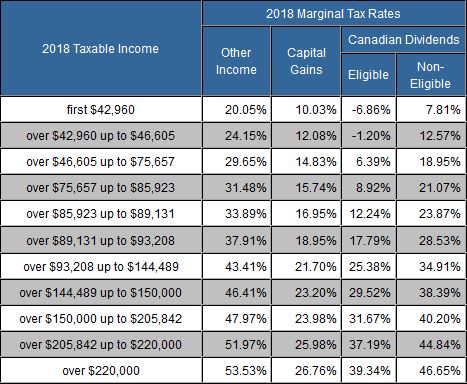

Taxtips Ca Ontario 2017 2018 Income Tax Rates

Personal Income Taxes In Canada Revenue Rates And Rationale Hillnotes

Canada Capital Gains Tax Calculator 2021 Nesto Ca

Taxtips Ca Canada S Top Marginal Tax Rates By Province Territory

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Canada Tax Deductions Tax Credits To Take Advantage Of Business Tax Deductions Tax Deductions Tax Credits

Tax Brackets Canada 2022 Filing Taxes

High Income Earners Need Specialized Advice Investment Executive

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Will Capital Gains Or Losses Affect Your 2021 Income Tax Filing What You Need To Know

How New Capital Gains Rules May Drastically Impact Your Tax Situation Youtube Capital Gain Gain Capitals