puerto rico tax incentive act

100 tax exemption from. Puerto Rico Tax Incentives.

New Puerto Rico Tax Incentives Code Act 60 Explained 20 22

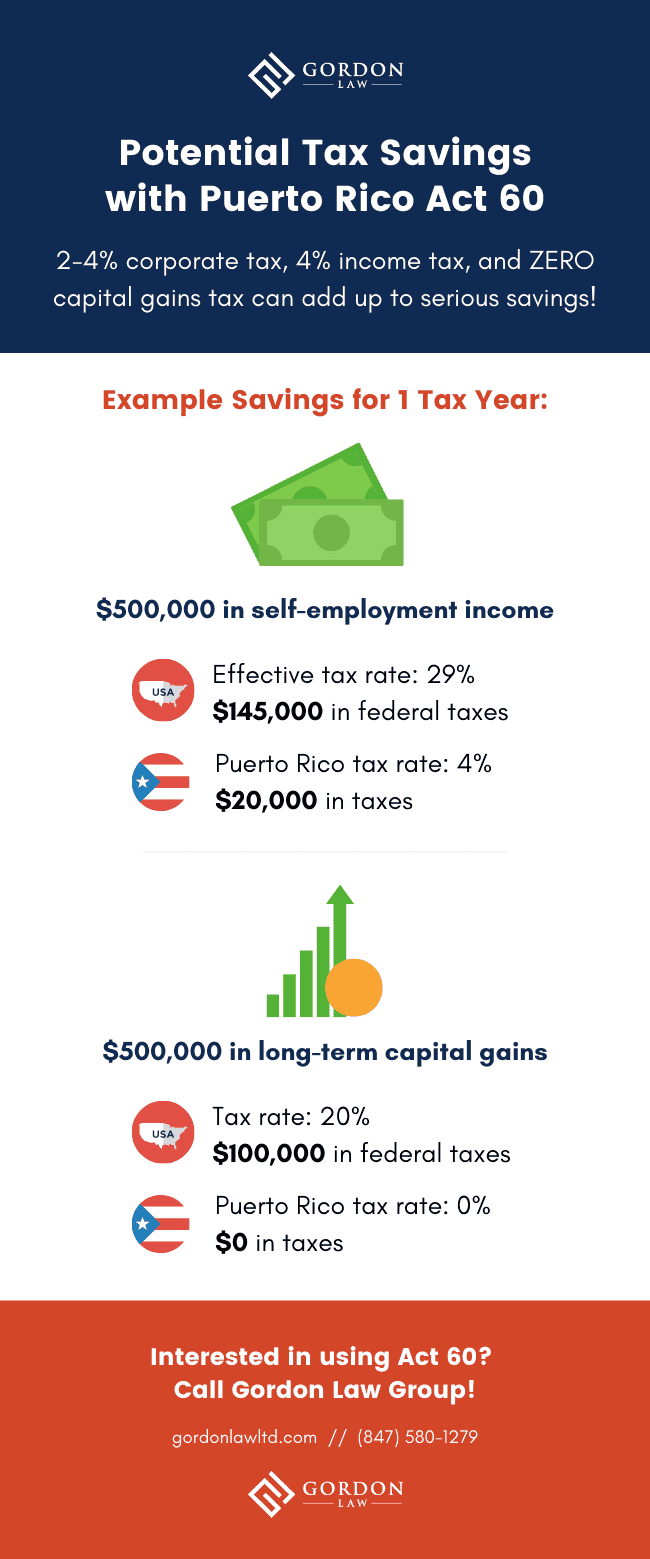

Tax reductions on passive income and capital gains.

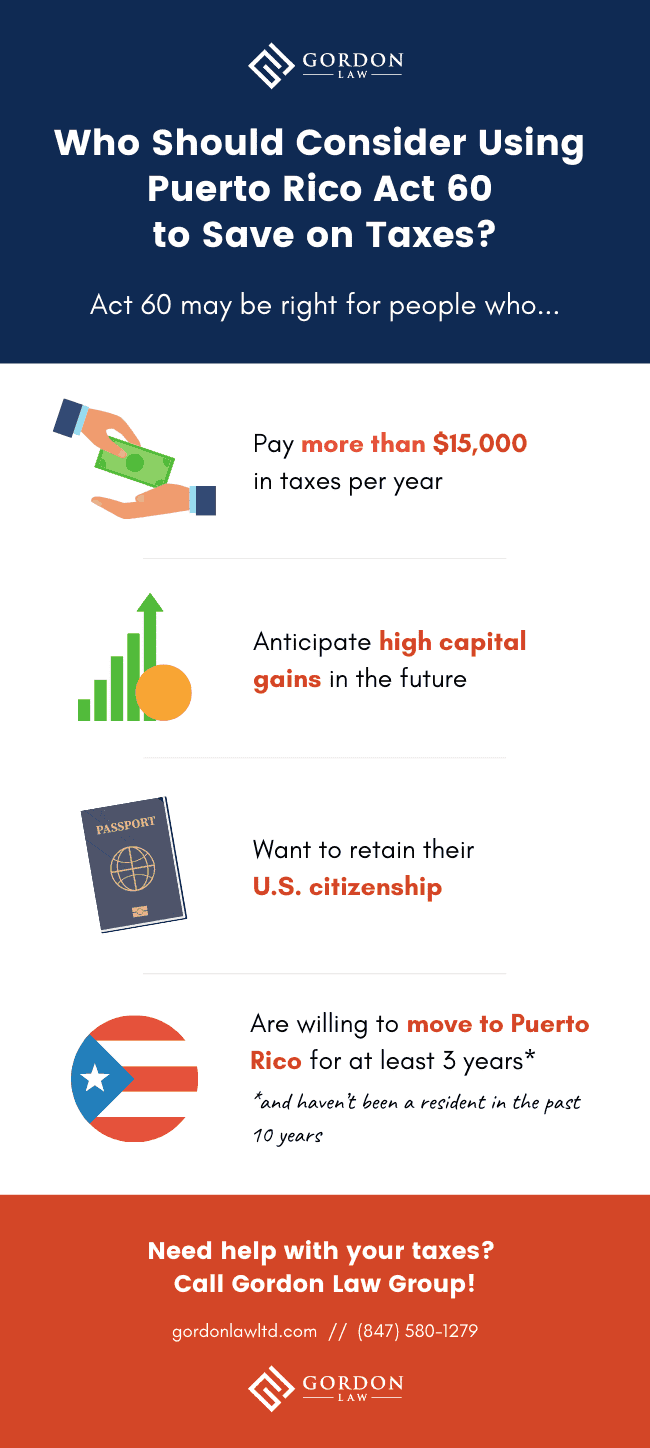

. This Act was designed to help accelerate the economic recovery of Puerto Rico. For some Americans burdened by federal and state taxes a move to Puerto Rico may reap huge rewards. The tax incentives enjoyed by Individual Resident Investors.

In 2012 the territory enacted laws that. Make Puerto Rico Your New Home. Now known as Chapter 3 of the Incentives Code Puerto Ricos Act 20 was originally known as the Export Services Act.

Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS INCENTIVE PROGRAMS Contact. Posted on June 16 2021 by admin. Puerto Ricos tax incentive Act 14 is titled the Return and Retention of Doctors in Puerto Rico and was established on February 21 2017.

Puerto Ricos Tax Incentive Act 14. In Puerto Rico are perhaps the most impressive of all Puerto Rican tax incentives. Puerto Rico Tax Incentives.

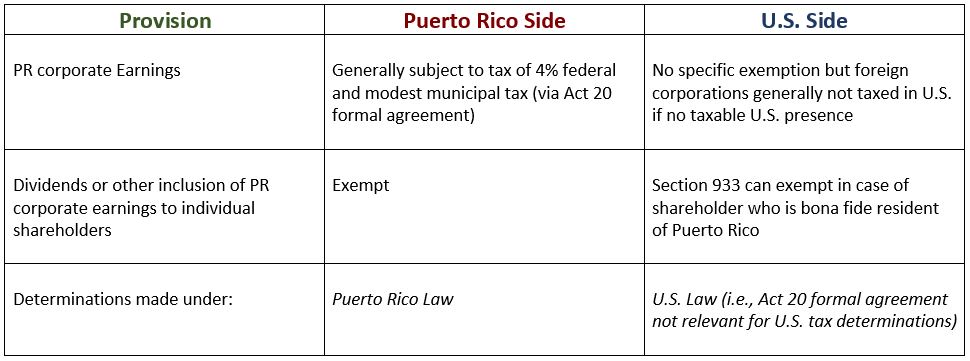

It means that under Puerto Rico Incentives Code 60 if an individual is granted Puerto Rico tax exemption under the act long term gains as a result of investments made after becoming a. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business. Of particular interest are Chapter 2 of Act 60 for.

Act 20 Puerto Rico Tax Incentives. On January 17 2012 Puerto Rico enacted Act 22 known as the Individual Investors Act. The mandatory annual donation to Puerto Rican charity increased from 5000 to 10000.

And adopts tax incentives for. Puerto Rico Tax Act 22. 4 Fixed Income Tax Rate on Income related to export of services or goods.

They say you can form a. 0 US Federal Income Tax. The legislation allows Puerto Rico to offer qualifying businesses that export services from the island nation the opportunity to cut their corporate tax rate to a mere 4.

Act 22 - The Individual Investors Act now included under Act 60 of PR Tax Incentive Code of July 2019 Act 22 as amended also known as The Individual Investors Act. Puerto Rico Act 60 Incentives Code Puerto Rico Act 60 Incentives Code Tax Implications. 73 of 2008 as amended known as the Economic Incentives for the Development of Puerto Rico Act the Act is the current industrial development incentives law in effect.

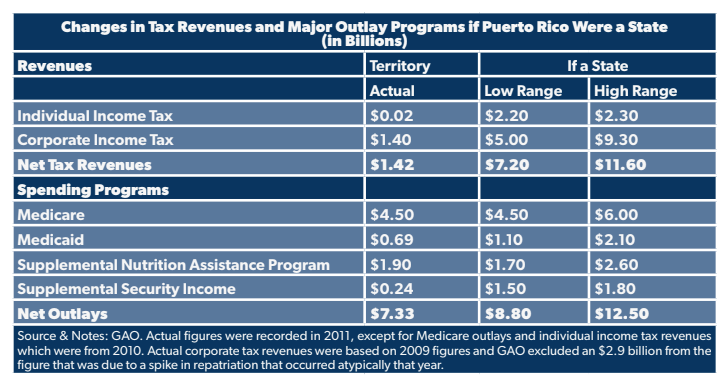

In order to promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education simplify processes optimize and provide greater transparency Act 60-2019 was signed which establishes the new Puerto Rico Incentives Code. Form 8898 requires the taxpayer to provide information. This is the time to invest in puerto rico.

Citizens that become residents of Puerto Rico. An economic development tool. 100 Tax Exemption on Income Tax Rate from.

One of the most well-known Puerto Rican tax incentives the Individual Resident Investor tax incentive is available to any person who was not a resident of Puerto Rico for the. The incentives are particularly attractive to US. The tax incentive offer is mainly a four 4 income tax rate for new banking and financial businesses established in Puerto Rico under qualifying circumstances.

Act 22 became more costly to comply with. Puerto Rico Incentives Code Act. Puerto Ricos Act 22 tax incentives offers one of the most effective tax savings mechanisms on passive income earned.

4 or 8 fixed income. Some offshore gurus claim that you can take advantage of Act 60 benefits while you live in the US. The taxpayer moving to Puerto Rico is required to file Form 8898 with the IRS and file Form 1040 for the year of move.

To stimulate economic growth Puerto Rico. Along with Puerto Rico Tax Act 20 Puerto Rico adopted an additional incentive the Act to Promote the Relocation of Individual Investors Puerto Rico Tax Act 22. Although it is part of the United States and the same laws apply it has an independent tax system where the IRS lacks taxation jurisdiction.

And within the first two years of living. On July 1 2019 Puerto Rico enacted legislation providing tax incentives for US. In January of 2012 Puerto Rico passed legislation making it a tax haven for US.

The Puerto Rico Incentives only work if you live in Puerto Rico.

A Detailed Analysis Of Puerto Rico S Tax Incentive Programs Premier Offshore Company Services

Acts 20 And 22 Created A Class Of Intermediaries Who Manage Tax Exemptions Centro De Periodismo Investigativocentro De Periodismo Investigativo

Puerto Rico Tax Incentives Puerto Rico Luxury In 2021 Puerto Rico Architecture Places To Visit

A Red Card For Puerto Rico Tax Incentives Washington Dc Tax Law Attorney Montgomery County Irs Audit Lawyer

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Puerto Rico Tax Act 60 Business Opportunities And Tax Incentives In The Caribbean

Puerto Rico Extends Due Dates For Retirement Plan Tax Reporting And Withholding Obligations Due To Covid 19 Ogletree Deakins

Tax Incentives Is Relocating To Puerto Rico The Right Move For You

Guide To Income Tax In Puerto Rico

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

The Puerto Rico Tax Haven Will Act 20 Work For You

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Enjoy Lower Taxes With Puerto Rico S Act 60 Tax Incentives Relocate To Puerto Rico With Act 60 20 22

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Mayaguez Puerto Rico Architectural Gem Of The West Mayaguez Puerto Rico Puerto

Puerto Rico S Economic Development Opening With Acts 20 22 And Opportunity Zones Grant Thornton