seattle payroll tax ordinance

Publishers of Newspapers Magazines and Periodicals. AN ORDINANCE relating to taxation.

Seattle S Payroll Expense Tax On Salaries Of Top Earners Bader Martin

Amending the payroll expense tax on persons engaging in business in Seattle.

. Adding a new Chapter 538 to the Seattle Municipal Code. Signed Ordinance 126309 4. The ordinance takes effect at the start of 2021 and sunsets at the end of 2040.

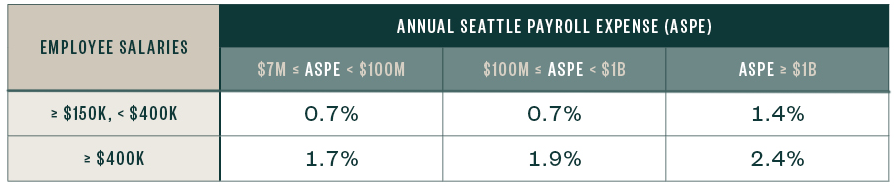

The payroll expense tax. A business must have at least 7 million in Seattle payroll in the prior calendar year to be subject to the tax. The payroll expense tax is based.

Imposing a payroll expense tax on persons engaging in business in Seattle. Amending Section 538020 of the Seattle Municipal Code. Ordinance 126109 was passed the same day establishing a spending plan for the proceeds generated by the payroll expense tax.

Adding a new Chapter 538 to the Seattle Municipal Code. The City of Seattle passed a Commuter Benefits Ordinance which became effective on January 1 2020. The payroll expense tax is levied upon businesses not individual employees.

5 AN ORDINANCE relating to taxation. For employees who perform work partly within and partly outside Seattle the compensation paid in Seattle to those employees shall be for each individual employee the portion of the employees annual compensation which the total number of the employees hours worked within Seattle bears to the total number of the employees hours worked within and. A business must have at least 7 million in Seattle payroll in the prior calendar year to be subject to the tax.

The payroll expense tax is a tax on employers that have Seattle annual payroll expense of 7 million or more. And amending Sections 530010 530060 555010 555040 555060 555150 555165 555220 555230 and 6208020 of the Seattle Municipal Code. 1 2022 and on January 1 of every year thereafter the dollar thresholds will increase based on the rate of growth of the prior years June-to-June Consumer Price Index.

Proceeds from the new payroll tax imposed by the ordinance introduced as Council Bill 119810 may only be used as described in subsections 2A and 2B of this ordinance. Adding a new Chapter 537 and a new Chapter 538 to 7 Title 5 of the Seattle Municipal Code. The City Council made extensive findings related to current health fiscal and social crises to support the ordinances.

On July 6 2020 the Seattle City Council passed City Ordinance Number 126108 imposing a payroll expense tax on persons engaging in business in Seattle. The Seattle City Council passed a bill creating a new payroll tax on persons engaged in business in Seattle. Gross receipts taxes payroll taxes head taxes regardless of the approach taken what these ordinances share is an overriding concern with asking big businesses to pay up which opponents say is.

The Seattle City Council passed a bill creating a new payroll tax on persons engaged in business in Seattle. And providing additional guidelines for expending proceeds. And adding a new Section 538025 to the Seattle Municipal Code.

The payroll expense tax applies to every business entity engaging in business within. Body WHEREAS on July 6 2020 the City Council passed Ordinance 126108 imposing a progressive tax on businesses with payrolls of 7 million and higher annually Payroll Expense. Ordinance 126108 and the Seattle Municipal Code SMC 538070 specify annual adjustments to the payroll expense dollar thresholds and exemption thresholds for the Payroll Expense Tax.

The draft rules address areas of ambiguity in the ordinance adopted by the Seattle City Council in July see PwCs Insight for more on the new payroll expense tax law. AN ORDINANCE related to creating a fund for Payroll Expense Tax revenues. Compensation includes amounts for the following whether based on profit or otherwise earned for services rendered or work performed whether paid directly or through an agent and whether in cash or property or the.

While the ordinance has not yet been signed by the mayor as of publication the tax was passed by the council on July 6 2020 by a veto-proof majority 7-2 and is expected to become law effective. The programs funded in this spending plan may be used to provide assistance to low income people who live or work in Seattle. The payroll tax referred to as JumpStart Seattle was passed in July 2020.

Imposing an employee hours tax that will be replaced by 6 a business payroll tax in 2021. Imposing a payroll expense tax on persons engaging in business in Seattle. The tax is progressive and imposes tiered rates based on the companys total payroll and the amount of compensation paid to employees earning above 150000 per year.

Seattle has proposed rules for its new payroll expense tax that took effect January 1 2021. 8 Citywide Chair of the Finance and Housing Committee alongside her Council colleagues with support from community stakeholders passed legislation today that would create the JumpStart Payroll Expense Tax Fund JumpStart Fund in the Citys treasury for the use of revenues raised from the progressive. And amending Sections 530010 530060.

AN ORDINANCE relating to taxation. The tax was imposed on companies doing business in Seattle with payrolls over 7 million a year. 1 2021 the City of Seattle imposes a payroll expense tax on businesses operating in Seattle.

Admission Tax Exemption for Music Venues. Businesses with 20 or more employees will be required to offer their employees the opportunity to make a monthly pre-tax payroll deduction for transit or vanpool expenses. Seattle Payroll Tax.

The ordinance encourages commuters to use transit options other than single occupancy vehicles. AN ORDINANCE relating to taxation. Admission Tax for Nightclubs.

Laundry Dry Cleaning Linen and Uniform Supply and Self-Service and Coin-Operated Laundry Services. The payroll expense tax is levied on the employers Seattle payroll expense which is defined as compensation paid in Seattle to employees. And amending Sections 530010 530060 555010 555040 555060 555150 555165 555220 555230 and 6208020 of the Seattle Municipal Code.

Update and Frequently Asked Questions. A lawsuit has been filed challenging the Seattle tax and there is a draft. Council Central Staff Memo- CB120030 3.

Councilmember Teresa Mosqueda Pos. Effective January of 2021 the City of Seattle will impose a payroll expense tax on businesses operating in Seattle. Adding a new Section 538055 to the Seattle Municipal Code.

Implementing Seattle Business Tax Ordinance. While the ordinance has not yet been signed by the mayor as of publication the tax. LEG Tax on Corporate Payroll Spending Plan ORD D10b Template last revised December 2 2019 1 1 2 3 CITY OF SEATTLE 4 ORDINANCE _____ 5 COUNCIL BILL _____ 6 title 7 AN ORDINANCE establishing a spending plan for the proceeds generated from the payroll.

Seattle S Payroll Expense Tax On Salaries Of Top Earners Bader Martin

Seattle Payroll Expense Excise Tax Details

Council Discusses Details Of Proposed Payroll Tax

Understanding The Mayor S Proposed 2022 Budget Part Ii The Payroll Tax

Understanding The Mayor S Proposed 2022 Budget Part Ii The Payroll Tax

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

Council Discusses Details Of Proposed Payroll Tax

How Seattle S New Payroll Tax On Amazon And Other Big Businesses Will Work Geekwire